9 min read

9 Ways to Improve Your Warehouse Pick Rate [Guide for 2026]

Slow picking rates drain warehouse profitability by increasing labor costs, delaying shipments, and leading to dissatisfied customers. Every minute...

Slow fulfillment kills sales. When orders arrive late, incomplete, or damaged, customers leave, and they don't come back.

Research shows 69% of shoppers won't purchase again if delivery doesn't arrive within two days of the promised date. Meanwhile, fulfillment costs continue to climb, with the average order costing 70% of its value to fulfill.

This guide delivers the specific systems, metrics, and operational changes that reduce errors, accelerate shipping, and protect your margins.

20 Years of Kitting Excellence

Ready to Streamline Your Supply Chain?

Join industry leaders achieving 99%+ SLA performance with flexible kitting.

Fulfillment, and 3PL solutions. We handle over 100 million kits annually

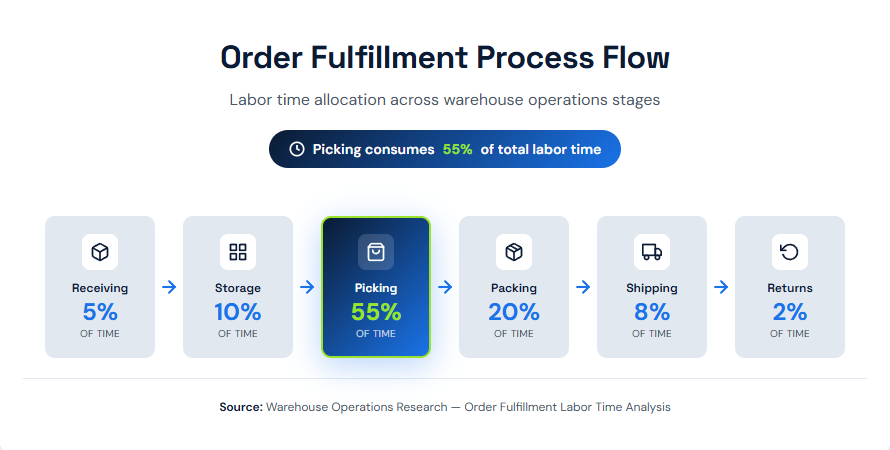

Order fulfillment encompasses every step between a customer clicking "buy" and receiving their package. This includes receiving inventory, storing products, picking items, packing orders, shipping packages, and processing returns.

The process sounds straightforward, but execution determines profitability. Organizations at the median achieve only a 90% perfect order index, according to the American Productivity and Quality Center, meaning one in ten orders has an error. Top performers reach 95% or higher through systematic process improvements.

|

Step |

Description |

Critical Success Factor |

|

Receiving |

Accepting and verifying incoming inventory |

Immediate quality inspection |

|

Storage |

Organizing products in warehouse locations |

Strategic slotting by velocity |

|

Picking |

Retrieving items for customer orders |

Route optimization |

|

Packing |

Preparing items for shipment |

Right-sized packaging |

|

Shipping |

Handing off to carriers |

Carrier rate optimization |

|

Returns |

Processing customer returns |

Clear policies, fast restocking |

Your fulfillment model shapes costs, control, and scalability. Each approach has distinct advantages depending on order volume, product type, and growth trajectory.

Managing fulfillment internally works best for small businesses with specialized products or those requiring strict quality control. You maintain complete oversight of packaging, branding, and customer experience. The tradeoff: capital investment in warehouse space, labor management, and technology systems. This model suits businesses shipping fewer than 100 orders daily with steady, predictable demand.

Outsourcing to a full-service logistics provider shifts warehousing, picking, packing, and shipping to a specialized partner.

According to Extensiv's 2024 3PL Warehouse Benchmark Report, only about 30% of warehouses take more than 90 minutes to fulfill and ship orders, which highlights significant variation in provider capabilities. The model eliminates facility costs and allows rapid geographic expansion through the provider's network. Businesses growing beyond 100-500 daily orders typically see the most substantial Return On Investment (ROI) from 3PL partnerships.

Suppliers ship directly to customers, eliminating inventory holding costs entirely. Margins compress because you're paying retail-adjacent prices, and delivery times extend since you don't control fulfillment speed. Dropshipping works for testing new product lines or for businesses prioritizing capital efficiency over delivery experience.

Combining in-house operations for bestsellers with B2B distribution services for slower-moving SKUs or geographic expansion creates flexibility. This approach requires robust inventory management systems to coordinate stock across locations without overselling or stockouts.

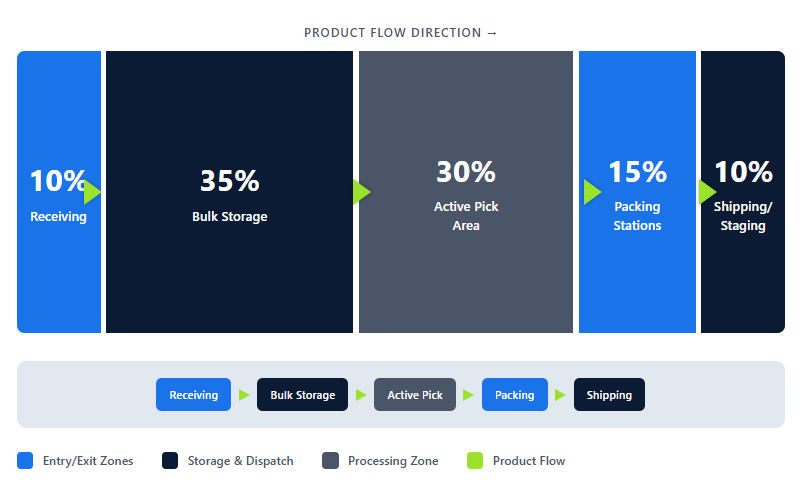

Where you place products determines how efficiently workers can pick them. Professional warehousing solutions prioritize strategic slotting to reduce travel time, which accounts for the majority of picking labor costs.

Categorize inventory by velocity:

Reorganize quarterly as sales patterns shift. Products that performed as C-items during Q1 may become A-items during holiday seasons.

You can also organize your warehouse so that inventory flows sequentially through receiving, storage, picking, packing, and shipping zones. Avoid backtracking. Create clearly marked zones with visual indicators, such as colored floor tape, hanging signs, and bin labels, to help workers navigate efficiently.

And when daily order volume exceeds 200-300 orders, assign workers to specific zones rather than having each picker traverse the entire warehouse. Items converge at a consolidation point before packing. This dramatically reduces individual travel distances.

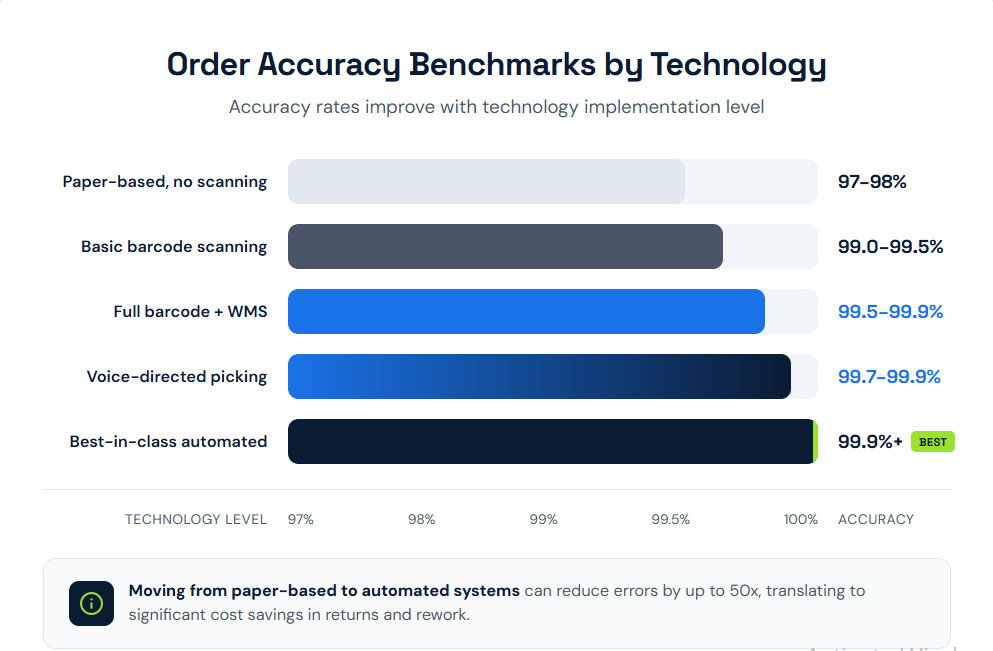

Manual processes create errors. Operations without barcode verification typically experience error rates of 1-3%, while full barcode implementation achieves 99.9% or higher accuracy.

A WMS (warehouse management system) creates digital visibility into inventory locations, generates optimized pick paths, and enforces verification at each process step. Pairing your WMS with supply chain data analytics unlocks deeper operational insights.

Key WMS capabilities include:

Modern cloud-based WMS solutions eliminate the significant upfront costs previously associated with warehouse technology, making implementation accessible for mid-sized operations.

Additionally, equip warehouse staff with mobile scanners or smartphones running WMS applications. Paperless workflows eliminate transcription errors and enable real-time inventory updates as transactions occur.

Order picking accounts for over 55% of warehouse operating expenses, according to industry research. Improving your warehouse pick rate directly impacts your bottom line."

Selecting the right picking methodology for your order profile reduces labor costs while improving accuracy:

Packaging decisions simultaneously affect shipping costs, product protection, and customer perception.

Packaging choices simultaneously influence shipping costs, product safety, and customer satisfaction. Carriers often apply dimensional weight pricing, which means they charge based on calculated size rather than the actual weight when the dimensional value is higher. Using unnecessarily large boxes leads to higher fees because unused space counts against you. It’s worth reviewing your carton assortment compared with actual orders to identify where you can improve sizing.

Another way to optimize is by standardizing carton sizes. Many operations find that limiting the assortment to 5–8 box sizes efficiently covers the vast majority of orders. Too many options slow down packers and increase the likelihood of choosing oversized packaging, while too few options push shipments into dimensional weight penalties. The Packers should clearly understand the rule of thumb: select the smallest box that safely protects the product without excessive filler.

Some companies take this further by automating the process. Systems that recommend or automatically dispense the appropriately sized carton remove guesswork and ensure consistent right-sizing across shifts and personnel.

Sustainability is also increasingly influential in packaging strategy. A McKinsey survey found more than 35% of consumers are willing to pay $1-2 extra for environmentally sustainable shipping, rising to over 55% among 18- to 34-year-olds. Recyclable materials and right-sized packaging reduce waste while appealing to environmentally conscious customers.

Consumer expectations have shifted. According to McKinsey's 2024 consumer research, speed dropped from the top priority in 2022 to fifth place by 2024. What matters now: delivering within the promised window.

Ninety percent of consumers will wait 2-3 days for free shipping. Rather than promising aggressive timelines you can't consistently meet, provide realistic delivery windows with high confidence. An on-time delivery builds more trust than an early delivery, which trains the customer to expect a speed you can't sustain.

Quote delivery windows that your operation can hit 95%+ of the time. If your average transit is 3 days with occasional 4-day shipments, quote 4-5 days. Meeting or beating expectations consistently outperforms occasionally delighting customers while frequently disappointing them.

When delays occur, notify customers before the expected delivery date passes. Having a logistics strategy for managing supply chain disruptions helps you respond proactively rather than reactively.

Consider offering options: wait for the delayed shipment, cancel for a refund, or modify the order. Roughly 85% of consumers don't consider orders "unacceptably late" if they arrive within 1-2 days of expectations, according to McKinsey, but only when they're informed.

Effective transportation management reduces dependence on a single provider and protects you from unexpected price changes, delays, or capacity limits. Ideally, you should maintain relationships with two or three carriers per service level and regularly compare rates by zone and weight, since regional carriers often come in cheaper while offering comparable service.

Rate-shopping software helps automate these decisions by comparing live rates during label creation and selecting the best option based on cost, speed, or predefined rules.

Finally, consolidating your total shipment volume strengthens your negotiation leverage, making it easier to secure discounts, especially during off-peak periods when carriers are looking to fill capacity.

Returns are inevitable. The goal isn't to eliminate returns, but to process them efficiently through streamlined reverse logistics while preserving customer relationships.

A McKinsey survey found that over 65% of consumers will abandon shopping carts when return policies are inflexible. Clear policies, prepaid return labels, and multiple return options (mail, store drop-off, locker) reduce friction while encouraging future purchases.

The faster the returned inventory re-enters sellable stock, the less carrying cost you absorb. Learning to reduce inventory waste across your operation compounds these savings. Prioritize returns processing as seriously as outbound fulfillment. Set standards: returned items should be inspected and restocked within 24-48 hours of receipt.

Track why customers return products. Sizing issues suggest product page improvements. Quality complaints indicate supplier problems. Shipping damage points to packing failures. Each return contains data to prevent future returns.

Track the following metrics to identify problems early and validate improvement initiatives.

Formula: (Orders shipped correctly ÷ Total orders shipped) × 100

Target: 99%+ for competitive operations. Rates below 95% put you at a significant disadvantage as customers choose more reliable merchants.

Measures orders delivered on time, complete, and undamaged, with accurate documentation. The American Productivity and Quality Center reports that median organizations achieve only 90%, while top performers target 95%+.

Time from order placement to shipment. Shorter cycles enable later order cutoffs and faster delivery without expedited shipping costs. Benchmark against competitors and track weekly trends.

Formula: (Physical inventory matching system records ÷ Total SKUs) × 100

Target: 99%+ accuracy. Inaccurate inventory leads to overselling, stockouts, and wasted labor spent hunting for "missing" products.

Total fulfillment costs (labor, packaging, overhead) divided by orders shipped. Track trends over time and segment by channel, product category, and order size to identify optimization opportunities.

Avoiding common fulfillment mistakes helps maintain accuracy, speed, and customer satisfaction as order volume grows.

Order accuracy rate serves as the single most critical fulfillment metric because errors directly damage customer relationships and inflate costs through returns processing, reshipping, and customer service labor. While delivery speed gets attention, research shows consumers prioritize receiving the correct items over receiving them quickly. Target 99%+ accuracy as your foundational benchmark.

Small businesses can compete by setting realistic delivery expectations and consistently meeting them. McKinsey research shows 90% of consumers will wait 2-3 days for free shipping. Rather than matching Amazon's speed, focus on reliability, personalized communication, and seamless returns. Customers value on-time delivery within the promised window more than raw speed – they weren't expecting it.

A competitive order accuracy rate ranges from 96% to 98%, while best-in-class operations achieve 99.5% to 99.9%. If your accuracy drops below 95%, you're likely losing customers to more reliable competitors. Operations using barcode scanning and warehouse management systems consistently outperform paper-based processes by 1-2 percentage points.

Fulfillment costs vary significantly based on product size, order complexity, and shipping distances. Industry data indicates that online retailers typically spend approximately 70% of the order value to fulfill an order, though this includes shipping. Internal warehouse costs (labor, packaging, overhead) usually range from $3 to $8 per order for standard operations. Track your cost per order over time and benchmark against industry averages for your product category.

The decision depends on your order volume, growth trajectory, and operational capabilities. In-house fulfillment works well for businesses shipping fewer than 100 orders daily who need maximum control over branding and quality. Third-party logistics becomes cost-effective at higher volumes (100-500+ daily orders) when facility costs, labor management, and technology investments would strain internal resources. Many businesses use hybrid approaches: fulfilling bestsellers internally while outsourcing specialty items or geographic expansion.

Implement barcode scanning at every process step to catch errors before they reach customers. Operations without barcode verification typically experience error rates of 1-3%, while full implementation achieves 99.9%+ accuracy. Beyond technology, optimize warehouse layout so similar-looking products are stored apart, train staff thoroughly on verification procedures, and analyze every error to identify root causes for prevention.

Consumer expectations vary by demographic, but the majority prefer free shipping over fast shipping. According to research, 90% of consumers will accept 2-3 day delivery when shipping is free, and fewer than 5% prioritize the fastest option regardless of price – the exception: specific product categories like groceries, where same-day expectations dominate. Focus on meeting your promised delivery window rather than competing solely on speed.

![9 Ways to Improve Your Warehouse Pick Rate [Guide for 2026]](https://www.getproductiv.com/hubfs/AI-Generated%20Media/Images/generate%20a%20image%20on%203PL%20industry%20representing%20a%20blog%209%20Ways%20to%20Improve%20Your%20Warehouse%20Pick%20Rate-1.png)

9 min read

Slow picking rates drain warehouse profitability by increasing labor costs, delaying shipments, and leading to dissatisfied customers. Every minute...

6 min read

Late shipments, inventory mismatches, customers demanding refunds; if you're managing order fulfillment, you know these headaches all too well. And...

![What is a 3PL Warehouse Management System? [Guide for 2026]](https://www.getproductiv.com/hubfs/GetProductiv_October2024/images/warehouse%203pl.jpg)

7 min read

Third-party logistics providers face mounting pressure to manage multiple clients, complex inventories, and demanding service level agreements...